Are you having a hard time figuring out how to get your CFA certification? Are you scared by the shocking pass rates, confused by the long CFA syllabus, or unsure which CFA books to pick? You’re not alone! Every year, thousands of prospective financial analysts encounter the same difficulties.

Here is the good news! You can overcome this issue if you have the correct plan and direction. Daniel from AI Exam Helper has considerable experience in these issues. He has helped thousands of professionals make the difficult CFA path easy.

He gave them personalized advice on everything from knowing the CFA Level One curriculum to making a study plan that increases their chances of success. So, you can hire him to get expert CFA exam help. However, read more to know all about the three levels of CFA.

What is CFA? Understanding the Gold Standard of Finance Certifications

The most prestigious certificate in financial analysis and investment management is the CFA certification. According to Daniel, the CFA Institute administers this internationally recognized accreditation, which is regarded as the gold standard for investment professionals everywhere.

Free Price Calculator

Get to know about Daniel:

- For smooth communication I use WhatsApp; Contact me on WhatsApp

- Each Client has a separate WhatsApp group

- Watch videos of me taking real exams: Quora Space

- How my most popular WhatsApp method works: Daniel WhatsApp Method

- I am Ranked #1 tutor on YouTube, Check out my YouTube Channel

- I keep my Clients info highly confidential by encrypting your name to a 4-digit code

- Get discounts on your next orders by suggesting me to your friends

Three progressive levels make up the CFA program, each of which builds on the one before it:

- CFA Level 1: In the first step, you learn foundation knowledge, which covers all major areas of finance.

- CFA Level 2: In this level, an In-depth analysis and application of investment tools are studied.

- CFA Level 3: In this final level, students study the Portfolio management and wealth planning synthesis.

Daniel highlights that obtaining your CFA charter provides access to prominent positions in financial consulting, investment banking, portfolio management, and research analysis. According to his experience, CFA charterholders usually earn more money and have more prospects for career progression.

👉 Want guaranteed CFA Level 1 help? Click here to WhatsApp Daniel now!

CFA Level 1: Your Gateway to Financial Excellence

Let’s dive in to know all about CFA Level 1:

CFA Level 1 Syllabus: Building Your Foundation

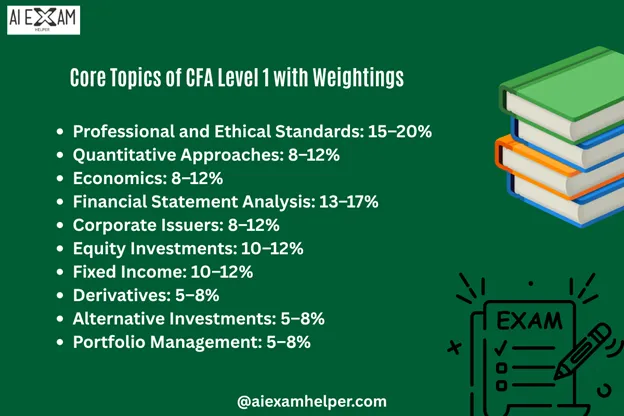

Daniel makes sure you understand every important subject by taking a thorough approach to the CFA Level 1 syllabus books. Ten key study areas are covered in the CFA Level 1 syllabus:

Core Topics with Weightings:

- Professional and Ethical Standards (15–20%): the cornerstone of appropriate behavior

- Quantitative Approaches (8–12%): Time value of money and statistical analysis

- Economics (8–12%): Principles of micro and macroeconomics

- Financial Statement Analysis (13–17%): Comprehending the financials of a business

- Corporate Issuers (8–12%): Foundations of corporate finance

- Equity Investments (10–12%): Evaluation and analysis of stocks

- Fixed Income (10–12%): Analysis of bond markets

- Derivatives (5-8%): Futures, swaps, and options

- Alternative Investments: Commodities, hedge funds, and real estate (5-8%)

- Portfolio Management (5-8%): Foundational theory of portfolios

Daniel makes sure his students understand not only how to study for CFA but also how each topic relates to the others by providing them with comprehensive CFA Level 1 syllabus PDF materials.

CFA Level 1 Books: Daniel’s Recommended Study Materials

The CFA Level 1 books you choose can make or ruin your preparation. Daniel suggests using a thoughtful mix of materials. So, here are the essential CFA Level 1 books PDF:

- Official CFA Institute Curriculum: It is probably the most reliable source to prepare for CFA.

- Schweser Study Notes: These notes by Schweser are concise and exam-focused

- Mark Meldrum’s Video Lectures: These lectures provide comprehensive explanations of many subjects.

- Kaplan Practice Exams: These practice exams provide Realistic practice questions.

Daniel provides students with PDF downloads of the CFA Level 1 books and teaches them how to properly incorporate these materials. He stresses that using the appropriate resources strategically is more important for success than having every book on hand.

CFA Level 1 Pass Rate: Understanding Your Odds

Strategic preparation is essential because the CFA Level 1 passing score has historically ranged between 38% and 49%. Daniel helps his students fully understand the challenges they face by analyzing patterns in CFA Level 1 pass rates:

- 2023: 44% (computer-based testing)

- 2022: 36% (transition year challenges)

- 2021: 25% (pandemic impact)

- Pre-2020: 40-43% average

Daniel’s students usually have higher-than-average pass rates since he focuses on looking at these figures and coming up with targeted answers to frequent problems.

CFA Level 1 Fees: Investment in Your Future

You can efficiently plan your certification path if you are aware of the CFA Level 1 expenses. Daniel breaks down the whole cost structure as follows:

- Early Registration: $1,000

- Standard Registration: $1,380

- Late Registration: $1,950

- Study Materials: $150-$3,000 (depending on provider)

Daniel assists his clients in realizing that paying CFA Level 1 fees is an investment in their future earnings potential, which frequently leads to yearly pay increases of $10,000 to $50,000.

CFA Level 2: Advanced Analysis and Application

After passing CFA Level 1, you must meet all the requirements for Level 2:

CFA Level 2 Syllabus: Deepening Your Expertise

The fundamentals of Level 1 are expanded upon with more intricate analysis in the CFA Level 2 course. Daniel emphasizes application and case study methodology in his preparation for CFA Level 2:

- Equity Valuation Models: It includes details about DCF, multiples, and residual income

- Fixed Income Analytics: It includes details about duration and convexity

- Corporate Finance: Capital budgeting and cost of capital

- Portfolio Management: Asset allocation and performance evaluation

Daniel’s practical experience in using these ideas professionally benefits his CFA Level 2 students.

CFA Level 2 Books: Advanced Study Materials

Daniel suggests the following books for CFA Level 2 students, which emphasize advanced analytical skills and case study techniques. SO, here are the essential CFA Level 2 Books:

- Official CFA Institute Curriculum: Updated case studies and examples

- Mark Meldrum Level 2 Package: Exceptional video explanations

- IFT Study Notes: Strong analytical framework

- UWorld Practice Questions: Comprehensive question bank

- Boston Institute CFA Review: Practice-intensive approach

Daniel highlights the value of case-based learning tools and offers PDF files for CFA Level 2 books. For the best understanding, he helps students combine traditional study materials with video information.

CFA Level 2 Fees: Advanced Level Investment

In order to plan for future certification, it is essential to comprehend CFA Level 2 fees. Daniel provides the entire cost breakdown:

- Early Registration: $1,000

- Standard Registration: $1,380

- Late Registration: $1,950

- Advanced Study Materials: $200-$4,000

Daniel assists clients in realizing that CFA Level 2 costs signify an ongoing investment in complex analytical abilities, which frequently leads to prospects for advancement and notable pay increases.

CFA Level 2 Pass Rate: The Most Challenging Hurdle

With a pass rate between 38 and 46 percent, the CFA Level 2 is usually the lowest of the three levels. Daniel gets his pupils ready for this task by:

- Intensive case study practice

- Mock exam simulations

- Time management strategies

- Stress management techniques

Many professionals have passed the CFA Level 2 exam on their first try thanks to his methodical approach.

CFA Level 3: Portfolio Management Mastery

After passing the CFA exam levels 1 and 2, here are the pinpoints to know about level 3:

CFA Level 3 Syllabus

Focuses on portfolio management and wealth planning. Daniel’s expertise in this area comes from his practical experience in investment management. So, here are the CFA Level 3 core topics:

- Behavioral Finance: Understanding investor psychology

- Private Wealth Management: Individual investor considerations

- Institutional Portfolio Management: Pension funds and endowments

- Trading and Performance Evaluation: Execution and measurement

- Risk Management: Comprehensive risk assessment

CFA Level 3 Books: Portfolio Management Excellence

Daniel’s curated selection of CFA Level 3 books emphasizes portfolio management and wealth planning mastery. Here is a list of essential CFA Level 3 books:

- Official CFA Institute Curriculum: Comprehensive portfolio management framework

- Schweser Level 3 Package: Essay writing and IPS templates

- Mark Meldrum Level 3 Course: Portfolio construction insights

- IFT Level 3 Materials: Behavioral finance focus

- AnalystPrep Level 3: Mock essay practice platform

Daniel provides specialized CFA Level 3 books and PDF materials focusing on essay techniques and portfolio case studies. He emphasizes that Level 3 success requires different study approaches compared to the multiple-choice format of earlier levels.

CFA Level 3 Fees: Final Investment in Excellence

CFA Level 3 fees represent your final financial commitment to earning the charter. Daniel details the complete investment:

- Early Registration: $1,000

- Standard Registration: $1,380

- Late Registration: $1,950

- Specialized Study Materials: $300-$5,000 (essay prep and portfolio software)

Daniel demonstrates that CFA Level 3 fees are the final step toward charter completion, typically resulting in immediate career advancement and substantial long-term earning potential increases.

CFA Level 3 Pass Rate: Crossing the Finish Line

The typical passing ranges of CFA Level 3 are from 52-58%. Daniel’s students excel at this level because he provides:

- Essay writing coaching

- Portfolio construction practice

- Investment Policy Statement development

- Mock exam preparation

How to Pass CFA Level 1 on the First Attempt: Daniel’s Proven Strategy

Daniel has developed a comprehensive methodology for how to pass CFA Level 1 on the first attempt. His approach addresses the most common failure points:

Phase 1: Making Foundation

- Complete overview of the CFA Level 1 syllabus

- Get a proper study schedule and fix your goals

- Master Ethical and Professional Standards

Phase 2: Core Learning

- Deep dive into Financial Statement Analysis

- Master Quantitative Methods and Economics

- Regular practice questions and review

Phase 3: Application and Practice

- Complete practice exams

- Identify and address weak areas

- Final review and exam strategies

Daniel’s students who follow this methodology consistently achieve pass rates well above the industry average.

Pass Rates Analysis: What the Numbers Mean?

Understanding CFA pass rates helps set realistic expectations and develop appropriate strategies. Daniel provides a comprehensive pass rate analysis:

- CFA Level 1: 38-49% (varies by testing window)

- CFA Level 2: 38-46% (historically lowest)

- CFA Level 3: 52-58% (highest but different format)

Factors Affecting Pass Rates:

- Study Time: 300+ hours recommended per level

- Educational Background: Finance backgrounds show a slight advantage

- Work Experience: Relevant experience correlates with success

- Preparation Method: Structured programs show higher success rates

Daniel’s analytical approach to pass rates helps students understand not just the statistics, but how to position themselves for success.

Why Choose Daniel as an AI Exam Helper for Your CFA Journey?

Daniel adds a lot of value to your CFA training because he knows a lot about the certification process and tailors his lessons to each student’s needs.

Daniel’s CFA Expertise:

- Deep Syllabus Knowledge: Complete mastery of all three CFA levels

- Industry Experience: Real-world application of CFA concepts

- Proven Record of Past Services: He is offering high pass rates consistently

- Personalized Exam Help Approach: He makes study plans according to your needs

Services Daniel Provides:

- Complete CFA Syllabus Guidance: Level-by-level breakdown

- Study Material Selection: Optimized CFA book recommendations

- Strategic Planning: Customized preparation timelines

- Mock CFA Exam Preparation: Real-time practice and results

Daniel knows that to become a certified financial advisor, he needs to do more than just pass tests. He also needs to set himself up for a successful job in finance. He helps you, gives you advice, and tells you what you need to know to finish this tough but worthwhile path.

Conclusion: Your CFA Success Starts Here

The path to CFA certification is certainly difficult, but with Daniel’s expert advice at AI Exam Helper, your success becomes not just feasible but likely. He has examined the whole CFA curriculum at all three levels in this extensive guide, examined pass rates to determine reasonable expectations, and evaluated the top CFA study guides and books.

Working smarter with the appropriate approach and support network is more important for CFA success than working harder. With above-average pass rates and the confidence required for sustained success in finance, Daniel’s tried-and-true approach has helped innumerable individuals change their careers through CFA certification.

So, Daniel is here to help you at every stage, whether you’re starting with CFA Level One or getting ready for the higher levels. To start your journey from CFA candidate to chartered professional, get in touch with Daniel at AI Exam Helper right now.

FAQs

Is CFA difficult?

Yes ofcourse! The CFA is challenging because it covers a wide range of topics and has a very rigorous test structure. For Level 1, pass rates are often below 50%. However, it can be very easy if you get expert guidance from Daniel at aieamhelper.com.

How to pass CFA Level 1 in the first attempt?

Stick to an organized study plan, focus on CFA Institute materials, take practice tests, and try to study every day for four to six months straight. Meanwhile, Daniel is always available to offer guaranteed exam help service to pass the CFA on the first attempt.

How to get old CFA results?

Sign in to your personal CFA Institute account and go to the “My Exam Results” section to see your old CFA scores.